Two of the largest railroad workers unions could be on strike as early as September 16. And since 40% of long-distance trade in the U.S. is hauled by rail, that’s a pretty big deal.

Naturally, this news made national headlines, and if the strike actually happens it has major implications for businesses. So let’s take a look at some potential impacts and how they might show up symptomatically in Google search.

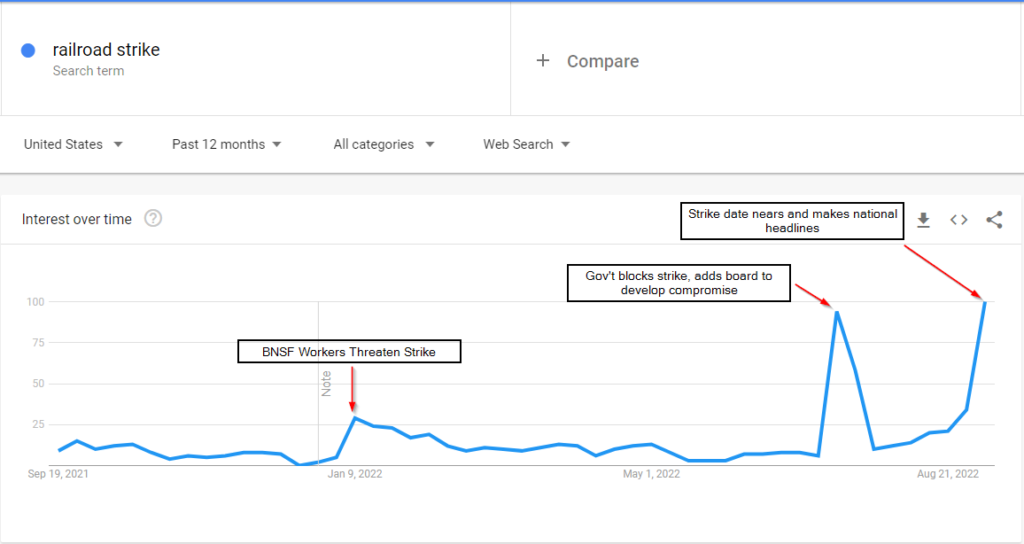

Evolution of Search Around the Railroad Strike

Like many of 2022’s crises, this one has developed over time and that is reflected in search demand. The more analyses I do on incidents like this, the more I find that (like the German firewood searches), we typically see two small spikes followed by a large one.

In this case, we see two smaller moments of media attention, with the large spike coming as the issue comes to a head.

As I have written before, if you’re a business that is affected by railroad trade (that’s pretty much everyone), you should be observing and beginning any mitigation efforts at the first spike.

At this point, every business should have a Google alert for headlines article titles containing “strike” as soon as they’re published. I think that future study will enable search professionals to detect anomalies and predict impacts quickly.

In this case, the impacts are pretty severe. So let’s look at what could happen and how we might see it in trending searches.

Downstream Effects of a Railroad Strike

The short answer is that everything gets more expensive, and quickly, leading to hoarding and panic buying. But, diving into some specific areas of concern, we can see how a railroad strike would impact specific industries. From that, we can make some armchair predictions about what we might see in Google search.

Data from AAR gives us some data to work with here on the most commonly-hauled cargo on North American rail.

Food Disruption

As you’ll note in the infographic above, rail was responsible for 1.6 million carloads of grain in 2019. Grain can also be hauled by truck, but one carload typically accounts for four truckloads. That means more drivers are needed (they aren’t there). And regardless, grain truck rates are already through the roof (source).

But the problem is deeper than that. You’ll note the 4 million carloads of coal. Although usage of coal has been declining since 2007, one industry has stayed consistent in its usage of coal – food production. The availability and price of energy has a direct impact on food production, with some items being more affected than others.

Worse still, chemicals is the second most-hauled commodity by rail. Disruption here could impact an agricultural industry already hurting from chemical shortages and delays.

Potential search impacts

- Knee-jerk “shortage” searches. As items become available and the shortage becomes public, searches for that item will spike, likely followed by panic-buying.

- Increase in search for items in bulk. Along with panic-buying and hoarding as in the COVID-19 pandemic, which will result in more searches for affected items in bulk.

- Increase in search for substitutes. Again during the pandemic we found consumers searched for replacements for flour, yeast, and other items that were unavailable. There will likely also be searches for informational content on using the substitutes.

Along with shortages, food would likely increase in price across the board.

Consumer Goods Shortages

“Intermodal shipments” refer to freight that moves from one mode to another. This is how your clothes, electronics, home goods, and countless other items arrive at your door. A container arrives on a ship from Asia, which gets stacked onto a train headed east.

Taking the rail link out of that equation is a major problem, and depending on the severity and duration of a railroad strike, we could see supply chain disruptions amid to COVID-19.

During the pandemic, goods couldn’t get from one place to another because people couldn’t go to work. During a strike, goods won’t get from one place to another because there isn’t an efficient way to get them there.

Potential Search Impacts

- Knee-jerk “shortage” searches. Just as with food. As soon as every major network runs a story about laptop shortages, people will consider a panic-buy

- Increase in “in stock” searches. Once the word is out and hoarding begins, we can expect an increase in people searching for products “in stock” (a la toilet paper 2020)

- Brief surge to locally-oriented searches. Depending on the prevailing herd mentality and the type of products short, consumers might look for local alternatives. If you can’t find a pair of shoes at Target, you might start searching for other local options (if they exist).

Blackouts

According to an article in Grid Brief, the executive director of the National Coal Transportation Association testified that 70% of power plants nationwide have less than 40 days of coal in stock, with 20% having less than 10 days of coal.

Coal is the largest commodity moved by rail, with one carload of coal carrying the ability to power twenty-one homes for a year. As mentioned in the Grid Brief article, some grids are strained as it is to keep up with demand. A prolonged strike would put even more stress on those power grids. Long term? Blackouts – and winter’s coming.

We can draw on the experience of the Texas power grid failure in 2021 for how that might play out.

Potential Search Impacts

- Spike in “generator” searches: Consumers will look for alternative power sources. However, this will also be impacted by an inability to easily get gasoline since the blackout will affect gas stations.

- Increase in searches for firewood: This spike was observed in the Texas winter blackout. People will search for an alternative form of heating.

- Increase in searches for propane equipment: During the Texas power outage, there was a spike in search demand for propane heaters and propane cooking implements (Hank Hill smiles). There were also search queries around using propane heaters indoors.

Conclusion

If the 2022 railroad strike does indeed happen, we’re in for a rough ride. Congress has the power to intervene in the case of railroad union strikes, but it’s unclear if they will.

Here are a few parting thoughts on how this kind of information can be useful to business and government agencies:

- Realtime search data could enable government relief agencies to quickly understand the needs of affected people, even if they aren’t asking for those things from said agencies.

- Big businesses should be watching these nascent search spikes and planning accordingly.

- There is an opportunity for businesses to use “how-to” search information from people using an alternative for the first time. They will have questions, and you can provide the answers.